Traders and investors have been trying to forecast market movements for as long as there have been markets.

Technical and fundamental analysis are two different ways to look at the market. One looks at historical price data and the other digs deep into intrinsic factors. But which one is the key to unveiling the market secrets? Let’s break down the differences, strengths, and weaknesses of both.

What is Fundamental Analysis?

Fundamental analysis is about finding the fair value of an asset. This means evaluating rational factors like earnings and macro data and irrational factors like market sentiment and media coverage.

Fundamental traders compare an asset’s intrinsic value to its current market price to see if it’s undervalued or overvalued. If undervalued, they buy; if overvalued, they may sell or wait for the price to drop.

For:

- Stock Trading: Analysts look at companies’ earnings reports, growth prospects, and industry positions.

- Forex Trading: Traders look at economic data like GDP, inflation, and changes in monetary policy.

Typically, fundamental analysis is used for long-term investing as it focuses on the underlying value of assets over time.

Key Components of Fundamental Analysis

1. Economic Indicators:

- Gross Domestic Product (GDP): Represents the overall economic output of a country. Higher GDP means a stronger economy and potentially stronger currency.

- Unemployment Rates: High unemployment means economic weakness, low unemployment means economic strength.

- Inflation Rates: Higher inflation means higher interest rates which means stronger currency.

- Interest Rates: Set by a country’s central bank, interest rates are a major driver of currency value. Higher interest rates attract foreign investment and spur more demand for the currency.

These indicators help traders understand the bigger picture and how it affects an asset’s value.

2. Political Stability:

Political events, government policies, and election outcomes can affect investor sentiment and currency strength. A stable political environment is generally good for a strong currency.

3. Monetary Policy:

Central banks like the Federal Reserve in the US play a big role. Policies to control inflation and stimulate growth can affect currency values.

4. Consumer Confidence and Spending:

High consumer confidence and spending means a strong economy, whereas low confidence and spending translates to a weak economy

5. Company Financials:

For stock trading, fundamental analysts look at balance sheets, income statements, and cash flow statements to assess a company’s financial health and performance.

6. Industry Conditions:

Understanding the industry a company operates is key. This means looking at competitors, market share, industry growth rates, and regulatory environment.

7. Management Quality:

A company’s management team can also make a big difference. Analysts look at the track record and decisions made by the leadership team.

Examples of Fundamental Analysis

- Consider a fundamental analyst evaluating a technology company. They would look at the company’s latest earnings report, compare its P/E ratio with industry peers, analyze its market share, and consider macroeconomic factors like tech sector growth and interest rates. If the intrinsic value determined from these analyses is higher than the current market price, the stock might be considered undervalued, prompting a buy decision.

- Similarly, fundamental analysis in forex involves examining economic indicators, interest rates, and political events to predict currency movements. For instance, when analyzing the USD/JPY pair, an investor might look at GDP growth rates, interest rate decisions by the Federal Reserve and the Bank of Japan, and inflation trends in both countries.

If the US shows strong GDP growth, higher interest rates, and stable inflation compared to Japan, the USD is likely to strengthen against the JPY. This analysis helps traders make informed decisions about buying or selling currency pairs based on anticipated economic performance and market sentiment.

What is Technical Analysis?

Technical analysis examines historical price movements to predict future price trends.

The main evidence for using technical analysis is that, theoretically, all current market information is reflected in the price. Technical traders generally ascribe to the belief that “It’s all in the charts!” This simply means that all known fundamental information is priced into the current market price.

Have you ever heard the old adage, “History tends to repeat itself“? This is basically another key point about technical analysis! Technical analysts look for similar patterns that have formed in the past and will form trade ideas believing that price could possibly act the same way that it did before. Technical analysis is not so much about prediction as it is about possibility.

Note that technical analysis is generally used for short-term trading, as it focuses on optimizing entry and exit points for trades based on past price data.

Key Components of Technical Analysis

1. Candlestick Charts and Patterns:

When someone says “technical analysis”, the first thing that comes to mind is a chart. Technical analysts use charts because they are the easiest way to visualize historical data. They believe that price action is the most reliable indicator of future price action. You can look at past data to help you spot trends and patterns that could help you find some great trading opportunities.

With all the traders who rely on technical analysis out there, these price patterns and indicator signals tend to become self-fulfilling. As more and more forex traders look for certain price levels and chart patterns, the more likely that these patterns will manifest themselves in the markets.

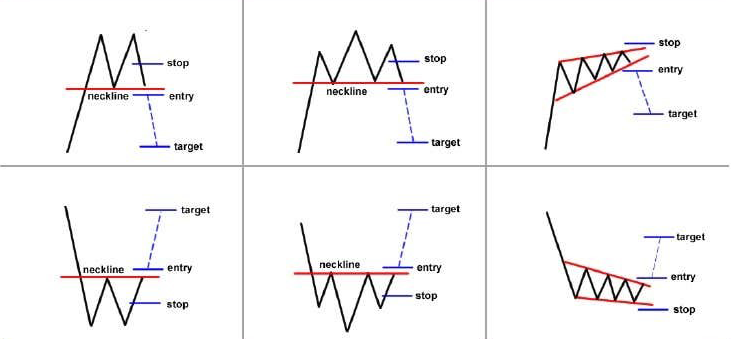

Patterns such as head and shoulders, triangles, and flags that indicate potential future price movements are based on historical patterns.

Few Chart Patterns

2. Price Trends:

Price trends identify the general direction in which an asset’s price is moving. Trends can be upward, downward, or sideways.

3. Support and Resistance Levels:

These are specific price points on a chart where an asset tends to stop and reverse. Support levels indicate where prices tend to find support as they are falling, and resistance levels are where prices tend to find resistance as they are rising.

4. Technical Indicators:

These include moving averages, relative strength index (RSI), MACD, and many more. These indicators help traders make sense of price data and make predictions about future price movements.

Example of Technical Analysis

Consider a technical analyst evaluating a GBP/USD chart. They would look at the price chart, identify patterns like head and shoulders or double tops, and use indicators like RSI to determine if the asset is overbought or oversold. They would also look for support and resistance levels to decide on entry and exit points for their trades.

Note that technical analysis is quite subjective. Just because someone is looking at the exact same chart setup or indicators does not mean that they will come up with the same idea of where the price may be headed.

The important thing is that you understand the concepts under technical analysis so you won’t get overwhelmed whenever somebody starts talking about Fibonacci, RSI, or pivot points.

Fundamental vs. Technical Analysis: A Comparison

Now that we have a basic understanding of both approaches, let us dive into their key differences.

Time Horizon

- Fundamental Analysis: Generally used for long-term investing. It is about finding value that will be realized over months or years.

- Technical Analysis: Typically used for short-term trading. It is about taking advantage of price movements that could happen in days, hours, or even minutes.

Data Focus

- Fundamental Analysis: Uses economic indicators, financial statements, and macroeconomic factors to assess value.

- Technical Analysis: Relies on historical price data and trading volumes to identify trends and patterns.

Purpose

- Fundamental Analysis: Aims to determine the intrinsic value of an asset and invest based on discrepancies between this value and the current market price.

- Technical Analysis: Aims to predict future price movements to find optimal entry and exit points for trades.

Type of Trader

- Fundamental Analysis: Attracts long-term investors who are patient and willing to hold onto their investments for extended periods.

- Technical Analysis: Appeals to short-term traders who seek to capitalize on quick price movements.

Pros and Cons of Fundamental Analysis

Pros:

Long-Term Perspective: Excellent for identifying enduring trends and discovering undervalued assets.

Comprehensive Insights: Delivers a holistic understanding of an asset’s worth by evaluating multiple factors.

Cons:

Not Suited for Short-Term Trading: Less effective for day trading due to its emphasis on long-term value.

Sector Specificity: Different sectors have unique nuances, making a one-size-fits-all approach challenging.

Pros and Cons of Technical Analysis

Pros:

Short-Term Opportunities: Ideal for identifying and trading on short-term fluctuations in price.

Self-Fulfilling: If many people use the same patterns and indicators, it can affect the market’s behavior.

Cons:

Not Foolproof: The fact that something happened in the past does not necessarily mean that it will be repeated in the future.

Subjectivity: As it was mentioned, two analysts can analyze the same data and draw different conclusions.

Combining Both Analyses

While some only use fundamental analysis and some only rely on technical analysis, a blend of the two can be useful. Here’s how you can blend the two approaches:

Volume Trends

Employ technical analysis to monitor trading volumes and compare them with fundamental events. For instance, if the trading volume increases when the earnings report is positive, it may support a bullish signal.

Timing the Market

Use technical analysis to determine the right time to enter and exit investments that have been selected through fundamental analysis. This can assist you in placing your trades at the right time.

Historical Reactions

Analyze how an asset reacted to similar fundamental factors in the past by using charts. It can provide you with some clues about future price direction.

Conclusion: Which Analysis Technique is Better?

In conclusion, the choice between fundamental and technical analysis is purely based on one’s trading personality and objectives. If you are a long-term trader, fundamental analysis will assist you in determining the actual value of an asset. If you are more of a short-term trader, technical analysis will help you navigate through price trends and the right time to execute trades.

Finally, the most intelligent traders are aware of both techniques and apply them to complement each other. This balanced approach allows you to make better and more profitable decisions. Whether you are wading through economic indicators or interpreting chart patterns, a dynamic approach will make you more likely to succeed in the financial markets.