cTrader, created by Spotware, is setting a new benchmark in the world of trading platforms, especially for Forex and CFD traders.

Unlike most platforms that make you choose between ease of use and advanced tools, cTrader manages to offer both. It is loaded with smart trading features like fast trade entry, quick order execution, rich charting tools, and lots of customization options, perfect for everyone from newbies to seasoned traders.

In this blog, let us explore the world of cTrader and its features in detail.

What is cTrader?

cTrader is an online trading platform designed to meet the demands of the modern trading landscape. Since its launch, cTrader has gained a large following due to its simplicity, powerful resources, and flexibility. Available on desktop, tablet, and mobile devices, traders can access their cTrader accounts from anywhere. If you want to analyze charts, place trades, or monitor the market depth, cTrader offers a feature-rich environment with robust tools and a clean interface.

Why Choose cTrader?

- Simple Interface: Designed to be easy for newbies but powerful enough for pros.

- Hedging: Open long and short positions in the same account.

- Level II Pricing: Monitor the market depth to see the prices at different levels.

- Cross-Platform Accessibility: Use cTrader on your desktop or switch to web or mobile for trading on the go.

- Algorithmic Trading: Through cAlgo, you can develop your own automated trading strategies, cBots, and Plugins using C# programming language.

- Comprehensive Charting: View detailed charts, apply indicators, and place quick trades directly from the chart.

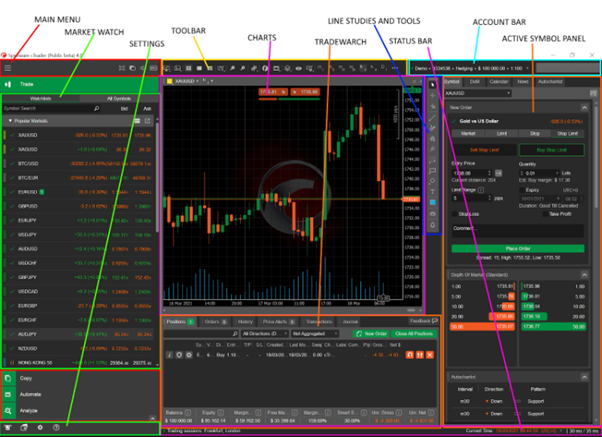

Getting to Know cTrader Interface

To get the most out of cTrader, you need to understand its layout. cTrader is organized into sections that streamline the trading process and make all the tools available at your fingertips.

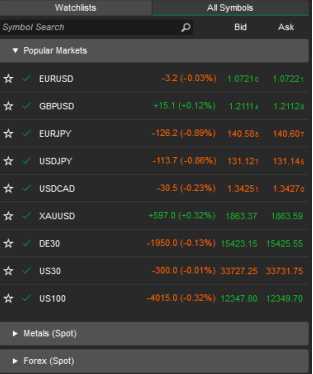

1. Market Watch

The Market Watch is where you can see available instruments, currency pairs, metals and CFDs. Here you can see the real-time prices of these instruments, perform trade actions, and open charts with one click. You can also add symbols to ‘Favorites’ for easy access and create a personalized trading experience.

2. Status Bar

The Status Bar at the bottom of the screen shows:

- Connection: Whether the platform is connected to the server.

- Trading Sessions: The active global trading sessions, like London, New York and Asian markets.

- Server Time: The current time in GMT to help you keep track of the market activity.

3. Chart Preferences Menu

This is where you can customize the chart. The menu allows you to create new orders, choose chart types (line, candlestick, bar charts), select indicators and time frames. The Chart Menu enables you to tailor the trading view to your strategy and style.

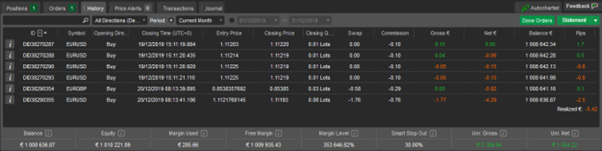

4. Trade Watch (Trading Terminal)

The Trade Watch, or Trading Terminal, is where you manage all your trades. It presents an organized view of everything trading-related, from open positions and pending orders to transaction history. It includes:

- Positions: View and manage open positions.

- Orders: Edit pending orders.

- History: View completed trades, and generate statements for records.

- Price Alerts: Set alerts that trigger when an asset hits a price, so you stay notified.

- Transactions and Journal: Log every trade and every change made on the platform, great for performance analysis.

cTrader Toolbars

cTrader toolbars give you quick access to commonly used features to make trading easier and faster.

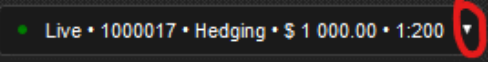

Account Bar: Switch between multiple accounts or update your credentials if needed.

Quick Links: Quickly enter full-screen mode, toggle sound, change platform theme, or adjust language to your preference.

Tool Bar: The Tool Bar has technical drawing tools like trend lines, horizontal and vertical lines, and Fibonacci retracement levels so you can enhance your charts for deeper analysis.

Advanced Charting Features

Charting is one of the key features of cTrader. It offers many options to customize and analyze charts so you can make better trading decisions.

Types of Charts

CTrader supports different chart types:

- Candlestick: Great for spotting trends and price action.

- Bar and Line: Provide simple views for quick trend spotting.

- HLC, Area, and Dot: For different views of price movement.

Customizing Chart Layouts

Traders can arrange charts in different layouts:

Single Chart Mode: One chart at a time, with tabs to switch between charts.

Multi-Chart Mode: View multiple charts at once, for comparing multiple assets.

Free-Chart Mode: Customize each chart for maximum control of your workspace.

Smart Chart Resizing with ‘Smart-Size’

cTrader’s in-house Smart-Size technology automatically resizes charts when the window is resized, so all charts become visible. This feature keeps your trading environment tidy and prevents disruption while analyzing.

Technical Indicators

Select from hundreds of indicators: trend, oscillators, volatility indicators. Add and edit indicators to fine-tune your analysis. Indicators are managed in the ‘Objects List’ where you can delete or edit each one.

Order Types and Execution Techniques

cTrader accommodates various order types, each serving a specific trading objective. Below are some of the order types and execution techniques available:

Market Order: Executes at the current best price available.

Limit Order: Executes only if the market reaches a specific price, ensuring a favorable entry or exit.

Stop Order: A stop order activates once the market reaches a set level, useful for capturing price momentum.

Trailing Stop Order: This unique order adjusts as the market moves in your favor, allowing you to lock in profits without a constant manual update.

Execution Techniques:

cTrader supports three main execution modes:

Instant Execution: Executes the order at the requested price without slippage.

Market Execution: Accepts slight slippage to increase the chances of a trade filling.

Request Execution: Executes only if the price meets a predefined level, hence protecting you from unfavorable price movements.

Risk Management Tools

Risk management is critical to any successful trading strategy, and cTrader provides several features to help traders control their exposure:

- Stop-Loss Orders: Set a stop-loss level to automatically close a position and limit losses if the price moves against you.

- Take-Profit Orders: Lock in profits by closing the trade once the asset reaches a target price.

Using these tools, traders can balance risk/reward and create a structured approach to protecting their investments.

Automation and Social Trading Tools

Automation and social trading features make cTrader particularly appealing to modern traders looking to streamline their strategies or learn from others.

cTrader Automate (cAlgo)

cTrader Automate is the platform’s algorithmic trading solution. It enables traders to build automated strategies and deploy them directly within cTrader using C#, a popular programming language. cTrader Automate is perfect for traders seeking a hands-free approach that still reflects their personal strategy.

cTrader Copy

For traders who want to replicate others’ strategies, cTrader Copy provides a social trading solution. With this feature, you can browse and follow experienced traders, automatically copying their trades into your account. This can serve as a learning tool or simply a way to diversify your trading approach.

cTrader Mobile App

With the surge in mobile trading, cTrader’s mobile app provides a feature-packed solution for traders on the go. The app offers essential trading tools, charting, and order management directly on your mobile device.

Its noteworthy features are:

- Real-Time Market Access: Trade Forex, CFDs, ETFs, and stocks from anywhere.

- Comprehensive Charting: Includes technical indicators, drawing tools, and chart-saving options.

- Flexible Order Types: Enter market orders, limit orders, and more from the convenience of your phone.

Conclusion - Why every trader should try cTrader

An impressive suite of tools and features come together on cTrader, making it a leading platform in today’s trading landscape. cTrader has earned its reputation as a popular trading platform among traders worldwide due to its intuitive interface, advanced charting, diverse order types, and flexible execution. Moreover, the platform provides all the tools for risk management, automation, and social trading for all skill levels.

If you are ready to take your trading experience to the next level, cTrader is a platform ready to help you along the way.