Indices

Indices, are a way where investors can gain exposure to financial markets without investing in company stocks directly.

| Instrument | Description | Average Spread (Pips) |

|---|---|---|

| GERMAN30 | DAX Index | 1.6 |

| DOW30 | Dow Jones 30 Index | 2.2 |

| S&P500 | S&P Index | 1.5 |

| NAS100 | Nasdaq 100 Index | 1.8 |

| UK100 | UK 100 Index | 12 |

| HONGKONG50 | Hang Seng 50 Index | 0.6 |

What is Indices Trade?

Indices trade also known as index trading is nothing but buying and selling a specific stock market index. It represents the performance of a group of stocks. Based on the rise and fall of the price of the index, determines whether one should buy or sell it. As the price within the index goes up the value of the index increases.

Comparatively, trading indices carries less risk than trading in individual stocks. Here, the investors aim to make a profit by speculating on the price movements of stock markets like FTSE 100, Dow Jones, etc. We at Amber Markets, allow investors to trade around the biggest global stock indices. Some of them include the Wall Street 30 index, NASDAQ, German DAX, and more. It provides the tightest spreads in the market with low-margin requirements.

When you’re trading indices you’re investing in the performance of the exchange itself, rather than investing in a single company on the exchange.

One of the great things about trading indices is it allows you to get more exposure to the entire exchange. Not only in exchange but also in the sector, and economy with a single position, rather than investing in an individual stock. The best way to trade indices is via CFDs.

There are two types when you trade indices online i.e. index cash CFDs and index futures CFDs. The main difference between these two types is that cash does not have an expiry date whereas the future has. It is known as rollover.

As an investor, you can profit from either a rise or fall in prices, depending on whether you have a long or short position. Comparatively, index trading is more secure than stock trading as, unlike a company, an index cannot go bankrupt.

Trade up to 16 CFDs with Amber Markets in a safe and secure online environment, anywhere.

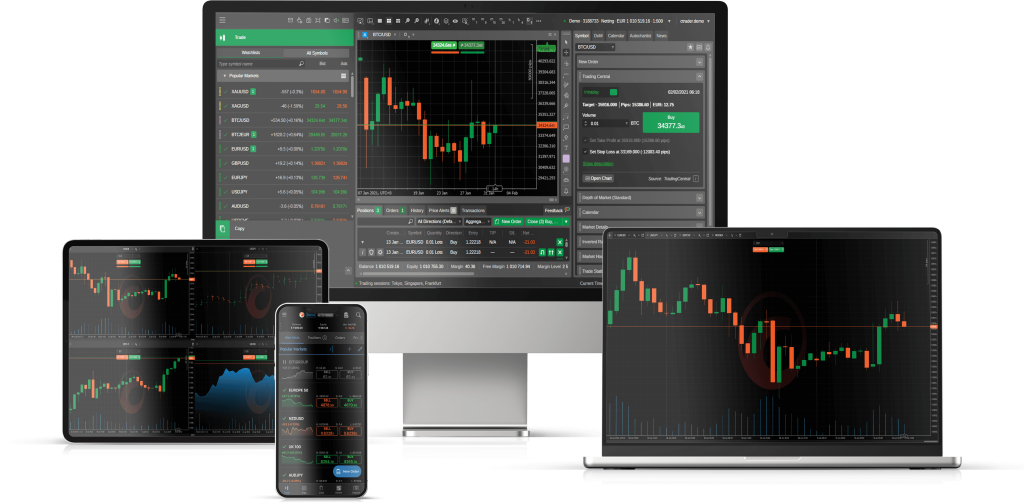

Amber Markets Platform is available for use on desktop, tablet, and mobile.

Scan to Download Android App

Frequently Asked questions

The New York Stock Exchange is the largest in the world with a market cap of over $25 trillion. The next biggest, by their market cap, are the NASDAQ, Tokyo Stock Exchange, and the Euronext Stock Exchange. Other major exchanges include the London Stock Exchange (LSE), the S&P 500, the Dow Jones Industrial Average, the Hong Kong Stock Exchange, and the DAX index.

Indexes offer a benchmark allowing you to see how your investments, and the economy overall, are performing. The clue is in the name – indices are indicators. Indices are there to provide a baseline to measure your portfolio and also to help investors decide on stock investments if they don’t know which individual stocks to invest in.

Trading indices carries less risk than other trading because you’re not investing in a single company, which has the potential to run into trouble in a short space of time. You also avoid the risk of losing all your money, because an index cannot go bankrupt like a company can. Indices benefit from the global economic situation so if one of the companies is doing badly on your index, the others may be doing well so your investment can still rise, unlike individual stock trading. Indices are passively managed too so you don’t have to pay fees to a portfolio manager to manage your investment.

Amber Markets enables its clients to begin trading indices on Amber Markets Trader, with a minimum account size of $100.