Forex

Forex Trading involves a network of buyers & sellers who can transfer currencies to each other at a fixed price. Are you interested in Forex Trading with Amber Markets?

Make a profit with Forex Trading at Amber Markets while buying and selling foreign currencies and be the best in trade.

| Instrument | Description | Average Spread (Pips) |

|---|---|---|

| AUDUSD | Australian Dollar vs US Dollar | 3 |

| EURUSD | Euro vs US Dollar | 1.4 |

| GBPUSD | British Pound vs US Dollar | 6 |

| NZDUSD | New Zealand Dollar vs US Dollar | 1.8 |

| USDCAD | US Dollar vs Canadian Dollar | 4 |

| USDCHF | US Dollar vs Swiss Franc | 11 |

| USDJPY | US Dollar vs Japanese Yen | 4 |

| AUDCAD | Australian Dollar vs Canadian US Dollar | 15 |

| AUDCHF | Australian Dollar vs Swiss Franc | 9 |

| AUDJPY | Australian Dollar vs Japanese Yen | 9 |

| AUDNZD | Australian Dollar vs New Zealand US Dollar | 11 |

| CADCHF | Canadian Dollar vs Swiss Franc | 22 |

| CADJPY | Canadian Dollar vs Japanese Yen | 7 |

| CHFJPY | Swiss Franc vs Japanese Yen | 17 |

| EURAUD | Euro vs Australian Dollar | 15 |

| EURCAD | Euro vs Canadian Dollar | 16 |

| EURCHF | Euro vs Swiss Franc | 11 |

| EURGBP | Euro vs British Pound | 2 |

| EURJPY | Euro vs Japanese yen | 9 |

| EURNZD | Euro vs New Zealand Dollar | 17 |

| GBPAUD | British Pound vs Australian Dollar | 20 |

| GBPCAD | British Pound vs Canadian Dollar | 37 |

| GBPCHF | British Pound vs Swiss Franc | 31 |

| GBPJPY | British Pound vsJapanese Yen | 15 |

| GBPNZD | British Pound vs New Zealand Dollar | 34 |

| NZDCAD | New Zealand Dollar vs Canadian Dollar | 15 |

| NZDCHF | New Zealand Dollar vs Swiss Franc | 9 |

| NZDJPY | New Zealand Dollar vs Japanese Yen | 11 |

What is Forex?

Foreign exchange, i.e. another name given to Forex. It is a network of buyers and sellers that can transfer the currency among one another at an agreed price. For example, if you travel abroad, then it is likely to have a forex transaction to be done. Mostly the forex marketplace speculates on national currencies that refer to banks, investors, and institutions.

The Forex market is the largest in the world, with trillions of dollars being traded every day. Traders can buy and sell currencies 24 hours a day, five days a week. We at Amber Markets provide Forex trading in over 45 currency pairs, including all the major, cross, and exotic currencies. Trading with us benefits with the tightest spreads providing leverage up to 500:1 with fast execution of orders.

Currencies are traded in pairs and they fluctuate based on different variables. Depending upon the demand, there is fluctuation in the price.

Some of the other factors that make a price difference include political events, economic health, government policies, and human behavior. Most of the traders buy and sell currency for the other aiming to make a good profit with forex trading.

Open an account with Amber Markets and start trading initially with $50. Get the best trading experience from our demo section which will help you to lead to a successful trade.

This practise will help you to know how and where to invest your real money. Join Amber Markets and be successful in Forex trading with our resources and experts.

Trade up to 16 CFDs with Amber Markets in a safe and secure online environment, anywhere.

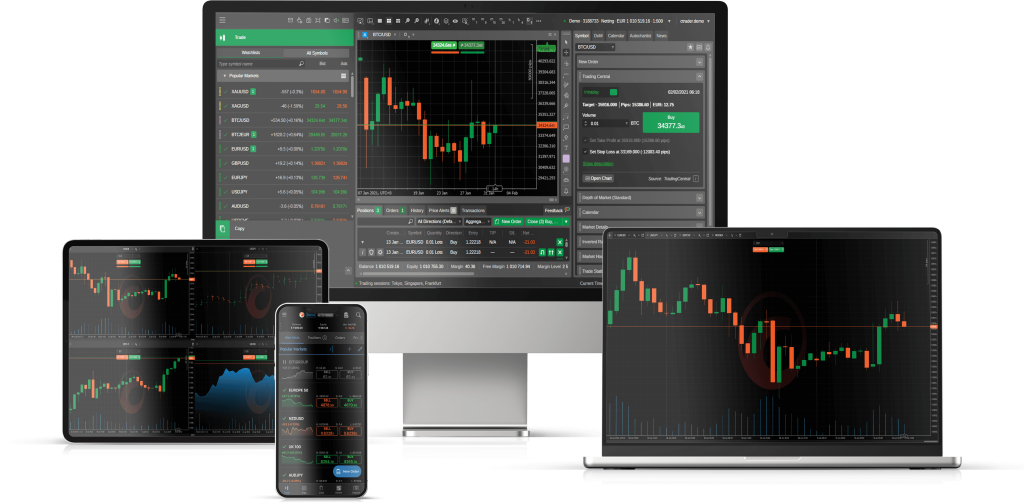

Amber Markets Platform is available for use on desktop, tablet, and mobile.

Scan to Download Android App

Frequently Asked questions

As an interbank market, that is decentralized, Forex isn’t owned by any specific person, country, or government. The world’s biggest banks, (Citi, JP Morgan, UBS, Barclays, Deutsche Bank, Goldman Sachs, HSBC, and Bank of America) based on supply and demand, determine the currency prices. Transactions only take place purely between the buyer and seller.

Currencies move depending on several things but most important is the supply and demand. If demand is high, the price will increase, If supply is high, the price will drop. Other factors include political events, changes in government policies, economic health, and general human behavior.

Leverage is where an individual or company uses borrowed money, from a brokerage, to invest in a currency or asset. This allows you to increase potential profits, without having the initial funds in your account. Amber Markets offers leverage of up to 500:1 and traders can choose how much leverage they wish to use.

The amount of money you need to begin trading depends on your appetite for risk, leverage ratio, and which financial instruments you are looking to trade. Minimum amounts vary depending on your brokerage, with Amber Markets, you can start trading Forex, metals, commodities, shares, and indices, from just $100.

Currencies are always traded in pairs and the values fluctuate depending on several variables. If demand is high, the price will increase, if demand is low the price drops. Other factors include political events, changes in government policies, economic health, and general human behavior. Traders will buy, or sell, currency for another currency depending on the goal of making a profit. Open an account with Amber Markets to begin trading with as little as $100. Amber Markets also offers a demo section where you can practice trading before using real money.